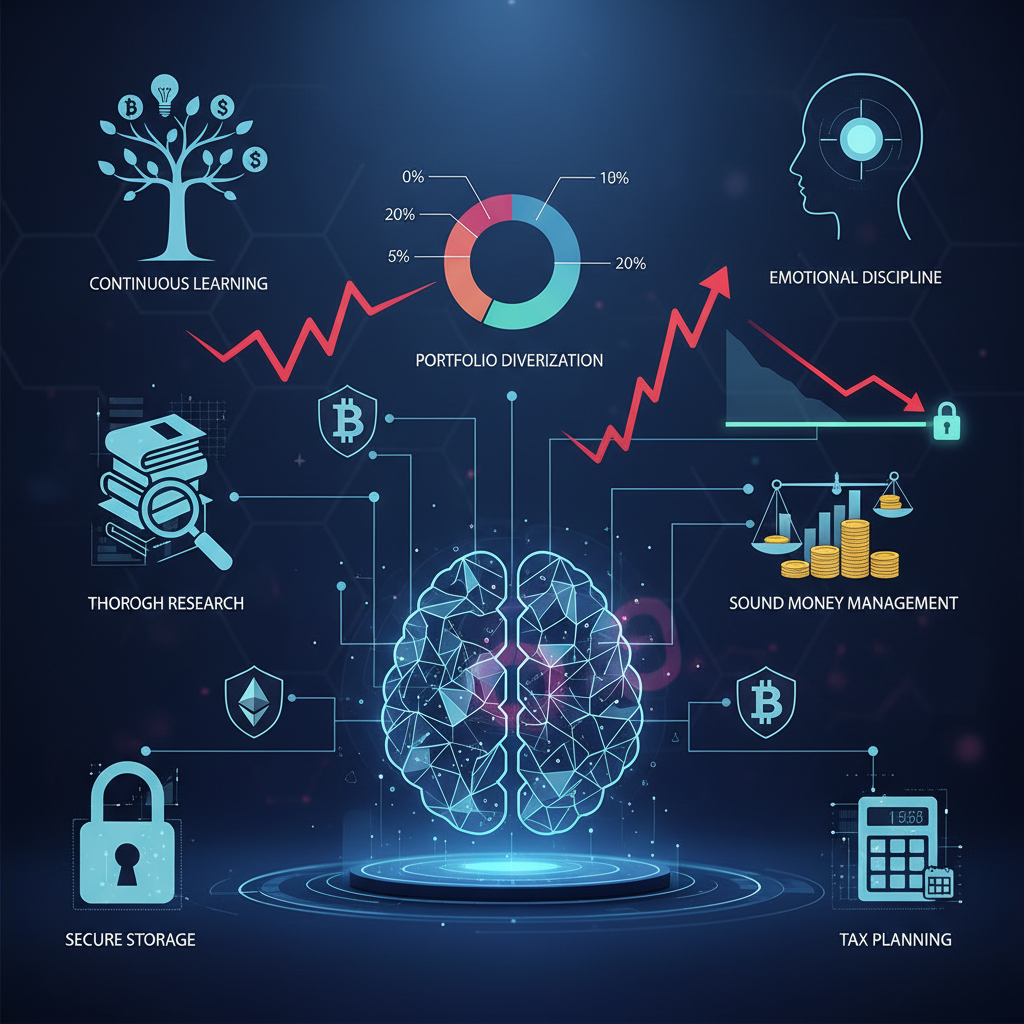

Ways to Minimize Risks in Cryptocurrency Trading

The Cryptocurrency Market: Challenges and Opportunities

Cryptocurrency trading opens up broad earning prospects, but simultaneously carries significant risks. The volatility of digital assets, rapid changes in market trends, and potential technical failures require traders to be cautious and strategic. In this article, we will explore effective ways to minimize risks that will help you preserve capital and increase your chances of success in the world of cryptocurrencies.

1. Thorough Research and Asset Selection

Before investing in any cryptocurrency, it is extremely important to conduct detailed research. This includes analyzing the underlying technology, the development team, the project's roadmap, its ecosystem, and community. Do not invest solely based on hype or social media recommendations. Look for projects with real potential and a clear value proposition.

2. Portfolio Diversification

As with any other type of investment, diversification is a key element of risk management. Spread your investments across different cryptocurrencies that have varying levels of risk and potential profitability. Do not invest all your funds in one asset. This will help reduce the impact of a significant price drop of one asset on your overall portfolio.

3. Using Stop-Loss Orders

Stop-loss orders are a powerful tool for limiting potential losses. By setting a stop-loss, you automatically sell an asset when its price reaches a certain level. This allows you to avoid emotional decisions during sharp market downturns and protect your capital from unforeseen losses.

4. Gradual Entry and Exit from the Market

Avoid investing all your funds at once. It is better to use a dollar-cost averaging (DCA) strategy, buying assets regularly, regardless of their current price. This helps smooth out the impact of volatility. Similarly, approach selling assets cautiously, gradually locking in profits rather than trying to sell everything at the peak.

5. Position Sizing Management

Do not risk too large a portion of your capital on a single trade. Professional traders typically risk no more than 1-2% of their total capital per trade. This rule helps to survive a series of losing trades without destroying your portfolio.

6. Storage Security

Storing cryptocurrencies also involves risks. Use reliable cold wallets (hardware wallets) for storing significant amounts. Avoid storing large volumes on exchanges, as they can be vulnerable to hacker attacks or bankruptcy. Ensure you securely store private keys and use two-factor authentication.

7. Emotion Management

Fear, greed, and panic can lead to catastrophic decisions in trading. Develop a clear trading strategy and stick to it, even when the market shows extreme movements. Psychological resilience is no less important than analytical skills.

8. Learning and Adaptation

The cryptocurrency market is constantly evolving. Be prepared to constantly learn, follow the news, analyze market trends, and adapt your strategies. The more you know, the better you can manage risks.

Remember: there is no trading method that completely eliminates risks. The goal is to manage them effectively and increase your chances of long-term success.

9. Using Demo Accounts

Before risking real money, it is worth practicing on demo accounts. This will allow you to familiarize yourself with trading platforms, test different strategies, and gain experience without financial losses.

10. Tax Planning

Do not forget about the tax obligations associated with cryptocurrency trading. Understanding local tax legislation and keeping accurate transaction records will help avoid trouble with tax authorities.

Applying these principles will help you navigate the volatile cryptocurrency market more confidently, protecting your capital and increasing your potential for profitable trades.

Comments

Loading comments...

No comments yet

Sign in to leave the first comment