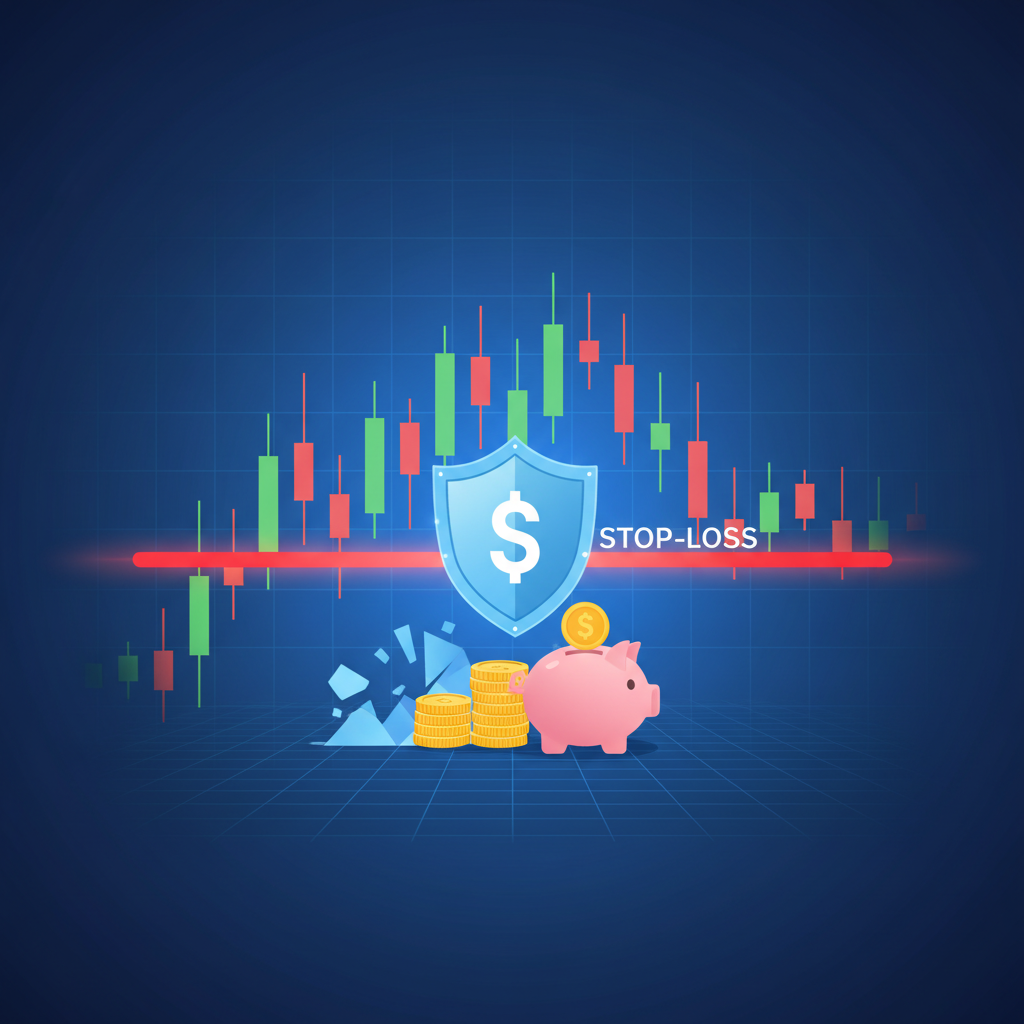

Stop-Loss: Reliable Protection for Your Trading

What is a stop-loss and why is it necessary?

In the world of trading, where asset prices constantly fluctuate and market conditions can change in a flash, protecting your capital is a paramount task. One of the most effective tools for achieving this goal is the stop-loss order. This mechanism, while seemingly simple, plays a crucial role in risk management and maintaining the profitability of your trades. Let's delve deeper into what a stop-loss is, why it's needed, and how to use it correctly.

Definition and Working Principle of Stop-Loss

A stop-loss is a trading order placed by a trader with a broker to automatically close a position when the asset's price reaches a certain, predetermined loss level. Its primary function is to limit potential losses from an adverse price movement against your trade. For example, if you bought a stock at $100 and set a stop-loss at $95, then if the price falls to $95, your order will be automatically executed, and you will sell the stock, locking in a loss of $5 per share.

Why is a Stop-Loss Needed? Key Advantages

Using stop-loss orders is the foundation of responsible trading. Here are the main reasons why this tool is indispensable:

- Loss Limitation: This is the most obvious advantage. A stop-loss prevents your losses from growing to catastrophic levels, protecting your trading capital from complete depletion.

- Psychological Comfort: Knowing that your potential losses are limited allows for more rational trading decisions, reducing the emotional pressure from the fear of significant losses.

- Process Automation: A stop-loss works automatically, even when you are not at your monitor. This is especially important in high volatility conditions or when you cannot constantly monitor the market.

- Discipline: Adhering to predetermined stop-loss levels helps maintain trading discipline, preventing impulsive decisions such as closing a position too early or, conversely, holding a losing trade in anticipation of a market reversal.

- Risk Management: A stop-loss is an integral part of a risk management strategy. It allows you to accurately calculate how much you are willing to lose on each trade and determine the position size accordingly.

"Without a stop-loss, you are trading blind, allowing the market to dictate the size of your losses. With a stop-loss, you control the risk and protect your capital."

How to Set a Stop-Loss Correctly? Methods and Strategies

Choosing the optimal level for a stop-loss depends on your trading strategy, asset type, market volatility, and your risk tolerance. Here are a few common methods:

1. Fixed Percentage of Deposit

This is one of the simplest and most popular methods. The trader decides what maximum percentage of their total deposit they are willing to risk per trade (usually 1-3%).

- Example: If your deposit is $10,000, and you decide to risk 2% per trade, then the maximum loss you can afford is $200. If you buy a stock at $50, the stop-loss will be set at a level where the potential loss per share reaches $200 (considering the position size).

2. Technical Levels (Support and Resistance)

This method is based on analyzing price charts. The stop-loss is placed slightly below a key support level (for long positions) or slightly above a key resistance level (for short positions).

- Example: If a stock is trading at $60, and you see a strong support level at $57, you might set your stop-loss at $56.50. A break of the support level would indicate a trend change or continuation downwards, and your stop-loss would trigger to prevent larger losses.

3. Volatility (ATR Indicator)

The Average True Range (ATR) indicator measures the average price range over a given period. It can be used to determine an appropriate stop-loss level that accounts for current market volatility.

- Example: If the current ATR for a stock is $1.50, and you enter a position at $50, you might set your stop-loss at $50 - (2 * $1.50) = $47. This means you give the price some room to fluctuate, but limit losses if the price starts to move sharply against you.

4. Trailing Stop-Loss

This is a dynamic type of stop-loss that automatically moves in the direction of your profitable position as the price rises. If the price falls, the stop-loss stays in place, locking in accumulated profit.

- Example: You bought a stock at $100, setting a trailing stop-loss with a $5 buffer. If the price rises to $110, the stop-loss automatically moves to $105. If the price then drops to $105, your position will be closed with a $5 profit. If the price continues to rise to $115, the stop-loss will move to $110.

Common Mistakes When Using Stop-Loss

Despite their obvious benefits, traders often make mistakes when working with stop-losses:

- Stop-loss too tight: Can lead to the premature closing of a profitable position due to normal market fluctuations.

- Stop-loss too wide: Increases the risk of significant losses if the market moves against you.

- Absence of a stop-loss: The biggest mistake, which can lead to catastrophic consequences.

- Moving the stop-loss towards the loss: Violating one's own discipline and consciously increasing risk.

- Ignoring the stop-loss: Not accounting for it when calculating position size.

Conclusion

A stop-loss is not just a technical detail but a key element of your trading strategy, providing capital protection and psychological stability. Correctly determining and timely setting stop-loss orders is the key to long-term success in financial markets. Learn to use this tool effectively, and it will become your reliable ally in the world of trading.

Comments

Loading comments...

No comments yet

Sign in to leave the first comment