How to Properly Earn on Funding

What is funding?

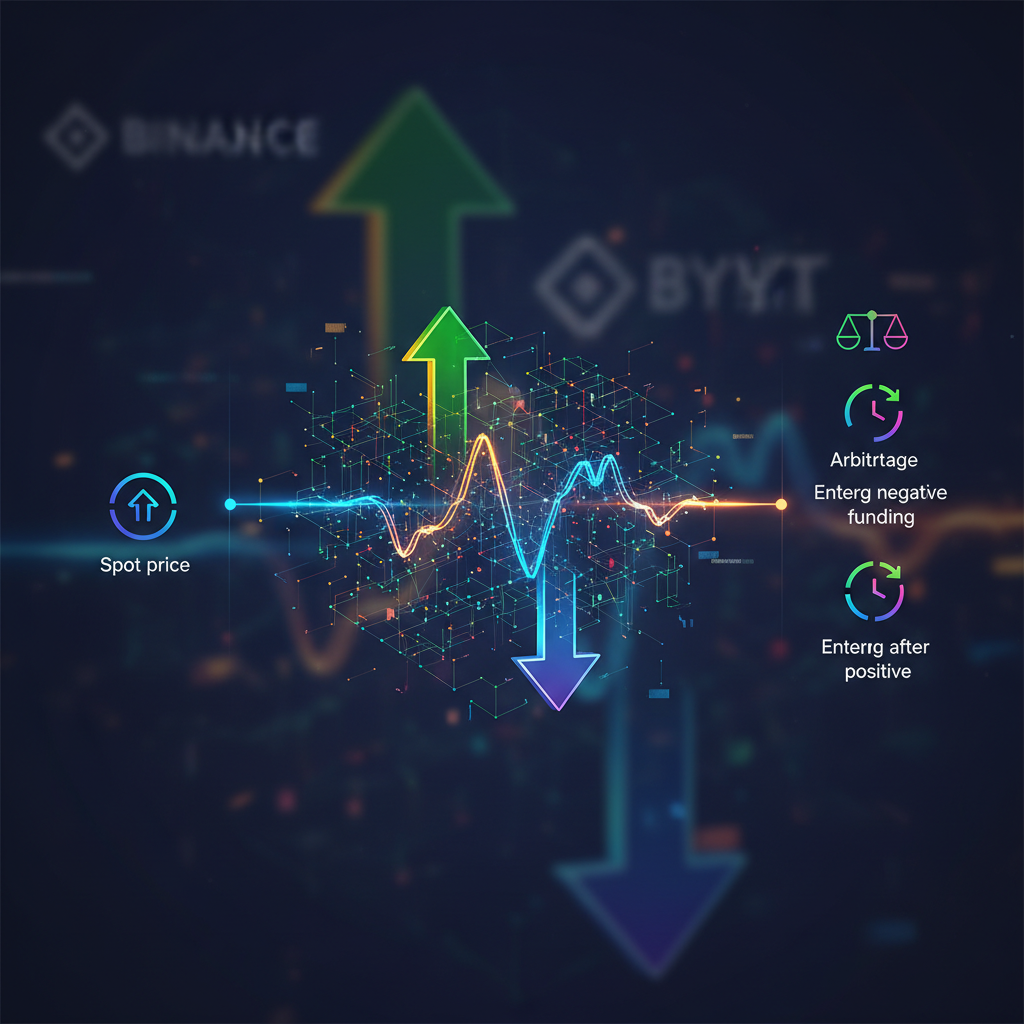

Funding is regular payments between traders in the futures market, which help maintain the price of a futures contract close to the spot price (market price of the asset).

- If the funding rate is positive, traders with long positions pay traders with short positions.

- If the rate is negative, the opposite occurs: shorts pay longs.

This mechanism is particularly relevant for perpetual futures, which are traded on cryptocurrency exchanges such as Binance, Bybit, OKX, and others.

How to find a favorable entry point to earn on funding?

There are several strategies that allow you to profit specifically from funding payments. Here are the most popular ones:

1. Arbitrage between exchanges

This is a strategy where two opposite positions are opened on different exchanges: one with a high funding rate, and the other with a lower one. The difference between these rates (the so-called spread) is your profit. It is important that both trades are hedged to minimize market risks.

2. Entering a few minutes before funding

From practice, it is known that approximately 5 minutes before the funding period changes, if the rate is negative, the price often starts to rise. This is explained by the fact that traders with short positions try to close deals or change the market direction to avoid paying funding. This rise usually corresponds to the approximate percentage value of the rate, opening an opportunity for short-term earnings.

3. Entering immediately after funding

Immediately after the funding period changes, a sharp price movement in the opposite direction is often observed. For example, after paying funding at a positive rate, the price may quickly decline. If you enter a short position at this moment, you can profit from a short downward movement.

Conclusions and warnings

There are other ways to earn on funding, but I am only aware of these three so far. I have personally tested all the approaches described above, and I am most fond of the second strategy – entering a few minutes before the funding period changes, when short-term growth is expected.

However, it is worth remembering that none of these strategies are a "magic grail" that guarantees profit in any situation. There are times when the price sharply moves in the opposite direction, which can lead to losses. To avoid unpleasantness:

- Carefully analyze the historical behavior of funding for each trading pair.

- Identify patterns – whether there is indeed growth before the rate change.

- Be sure to use stop orders to limit potential losses.

- Start with small volumes to test the strategy in practice.

Funding is an interesting tool that, with a competent approach, can become an additional source of profit for an experienced trader.

Comments

Loading comments...

No comments yet

Sign in to leave the first comment